Report From Marketing Research Class Reveals How Students Handle Expenses

Students do not see a lot of money, especially after spending it. Photo by Sonja Brandt.

By Benjamin Gordon

The BUS 366 marketing research class, taught by professor Timothy Heidorn, reached out to the Sower to share their research on how Concordia students pay and view college expenses.

College is expensive–estimated tuition with room and board brings the average cost for the 2020-21 Concordia school year to $44,040. Even with generous aid it is expected to average $14,610. These numbers do not account for laundry, gas, books and other necessities. Students thus must find a way to pay for tuition and non-tuition expenses through a combination of loans, jobs, scholarships and other means of funding.

The marketing research class found that 64% of Concordia students view the cost of college being overpriced but at the same time 75% of people say it is worth their time. These statistics remain reasonably consistent among people of different gender, major and religion. These figures remain somewhat close even among people whose views vary in the quality of education. Students seem to perceive college as expensive but worthwhile.

Students differ in their reasons on why college is worthwhile though. Around 74% say they need a degree for career goals in the future, which corresponds with the 74% of students who said they do not know what they would do without college. A higher percentage of males than females indicated they do not know what they would do without college . Both statistics seemingly show many view college as a path to a career.

“I believe that the experience that I’ve had here as a student … has significantly transformed me and will have a tremendous impact on my future income,” BUS 366 student Jallah Bolay said.

Careers are not the only thing that concerns students in their view on the worthiness of a degree, though, as 57% see the life lessons of college as important and 42% believe they will contribute more to society with a college degree.

At Concordia, students pay for school in several ways, the most obvious being scholarships from Concordia; around 96% of students report having an academic scholarship from Concordia and around 64% report having an extracurricular scholarship from Concordia. Sixty-six percent of students report having an outside scholarship not affiliated with Concordia.

“They provide scholarship opportunities to help … reduce the cost … more than other universities do,” Bolay said.

Another large source of money that students use to pay tuition is money out of pocket. Sixty-eight percent of students said family members contributed, and 63% said they themselves contributed personally. The report notes that the average family contribution to college in 2018 was $26,458 in the U.S. and students contributed an average of $3,339 personally.

Use of private loans to pay for college is low at Concordia, as only 12% of Concordia students report using them. However, 59% report using their federal loans. This percentage is still much lower than the national percentage of students who apply for federal aid; the report states that 75% of college students sign up for the Free Application for Federal Student Aid nationally. These numbers seem to correlate with the idea that only 34% of students believe a college degree will help pay off student loans.

Beyond tuition, students said they spent “a lot” or “very much” money on both necessities and non-necessities. About 51% of students say they spend a large amount on transportation and about 23% say they spend large amounts on clothes. According to the report, about half the people that attend Concordia are from Nebraska, meaning that weekend trips back home for them could be common and costly.

Students also choose to spend their money on less necessary items. About 19% of students say they spend large amounts on coffee, 11% say they spend a large amount on gifts and about 23% say they will spend a large amount on entertainment. Women spend almost double that of men on both coffee and gifts, but men spend more on entertainment than women. The report says that college students across the nation spend about $60 billion in non-tuition needs annually. $1 billion of that is on snacks and drinks alone.

“We have the education part of it but you have a little bit of these campus life activities too,” Bolay said. “I mean we are college students so … that’s always going to be part of the equation.”

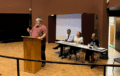

The class, after completing their research, compiled it and presented to their class. They then sent the Sower their results.

“Looking back at the process, I would say it was really a good challenge, because we had this deadline to come up with the project and present it to the entire class,” Bolay said.